The Federal Reserve controls the Federal Funds rate which sets the target borrowing rates for all banks in the United States. The stock market, bond market, and the general economy all run based on their in particular expectation of what the Federal Reserve is going to set their Federal Funds rate at. The Federal Reserve has tremendous power to slow down or overheat the economy. The Federal Reserve does this in order to maintain low unemployment numbers and to maintain low inflation numbers.

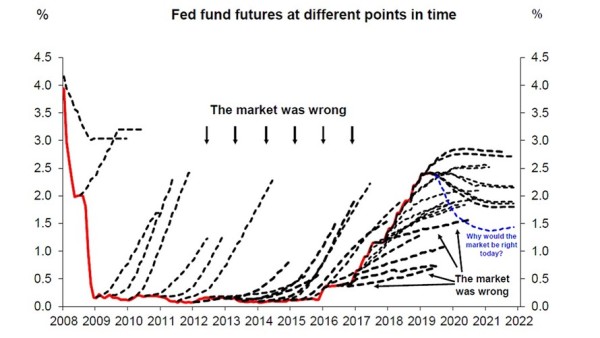

The below graph shows the market’s expectation of the Federal Funds rate and where it actually went during different periods of time. The market’s expectation of where the Federal Funds rate goes is very important in business expansion decisions.

You can see the market was wrong almost every single time when deciding where the Federal Funds rate was going to be at. Why should we panic today about rapid change if historically the market was almost always wrong about the Fed Funds rate?

Upload your infographic here and contribute to our community.

Upload your infographic here and contribute to our community.

Leave a Reply